Hail Risk 101

What is Hail Risk?

Hail risk is the exposure to property loss or missed business opportunity due to hail.It is an often overlooked dimension of risk management and has five distinct dimensions:

Enterprise Risk:

Popup 2

Popup here, sample text for the popup here

Insurance Risk:

Popup

Popup here, sample text for the popup here

Restoration Risk:

Popup

Popup here, sample text for the popup here

Identification Risk:

Popup

Popup here, sample text for the popup here

Notification Risk:

Popup

Popup here, sample text for the popup here

Enterprise Risk:

Popup 2

Popup here, sample text for the popup here

Insurance Risk:

Popup

Popup here, sample text for the popup here

Restoration Risk:

Popup

Popup here, sample text for the popup here

Identification Risk:

Popup

Popup here, sample text for the popup here

Notification Risk:

Popup

Popup here, sample text for the popup here

Why does hail risk matter?

More than 6.8 million properties had a hail-damaging event in 2021, according to Verisk.

There were 312 days of hail in 2023.

State Farm issued over $4 billion dollars in hail claims in 2023.

Hail Alley may be widening, bringing more hailstorms to Eastern states.[*]

This reality is forcing CRE owners and insurance carriers to reevaluate their hail risk strategies.

Notification Risk:

The risk of hail happening and you not knowing

The only certain way to confirm when hail strikes a property is through human observation, which is impractical. Radar is the best available tool but has limitations:

Range

Radar systems have limited range and may not provide comprehensive coverage for all properties.

Accuracy

Radar data can be subject to errors and inconsistencies, particularly in estimating hail size and intensity.

Downtime

Radar systems can experience downtime due to maintenance or technical issues, creating gaps in data.

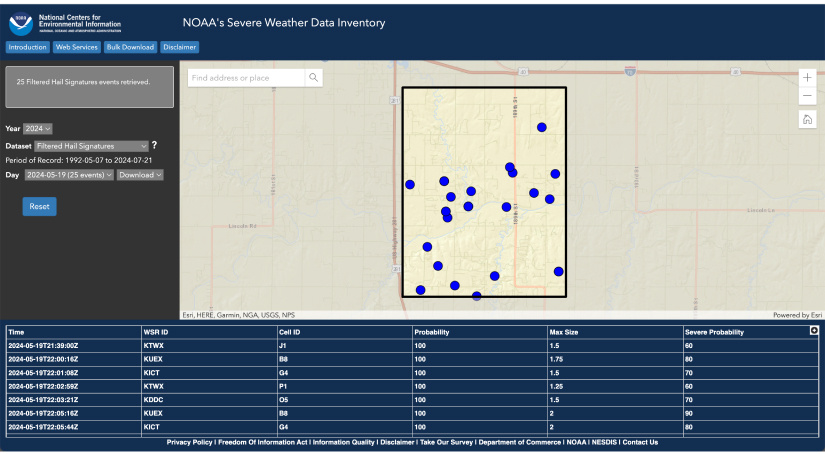

NOAA’s data is esoteric and requires technical expertise to utilize:

This leaves most owners to rely on verbal reports from their operations team, local weather reports, hail alert systems, and business intelligence companies that assemble daily hail maps from public databases like NOAA. The latter includes companies like CoreLogic.

Owners can conduct a daily review of hail maps and match that against their portfolio addresses for proactive hail risk mitigation, but this is a laborious and incomplete solution.

And while NOAA’s data is public, it is difficult to navigate and understand — which is why a secondary market exists.

Every system has limitations, with some data curators only reporting radar data from NOAA on storms that also have a live spotter, leaving rural gaps. Other alert sources may not differentiate between NOAA’s separate radars, combining readings taken hundreds of feet in the air with those reported at ground level.

Even when alerts are accurate, these systems only report estimated hail size. There is no consideration of the roof system and the building envelope’s condition. Hail that is 1.5” on an old TPO roof necessitates a faster response than 1.5” on a brand new standing seam metal roof.

This means the best monitoring solution for owners is one that:

Uses multiple radar and live spotting sources to reduce gaps

Curates notifications based on radar source, building envelope, and property goals

Identification Risk:

The risk of hail damage being overlooked, misidentified, or misunderstood

Unlike other perils, there is no international standard for defining or quantifying hail damage. This is due to hail’s complexity: the shape of a hailstone, density, velocity, response to wind, temperature, roof system, the roof’s age, and the material(s) used all affect a hailstone’s impact and the way in which its damage manifests.

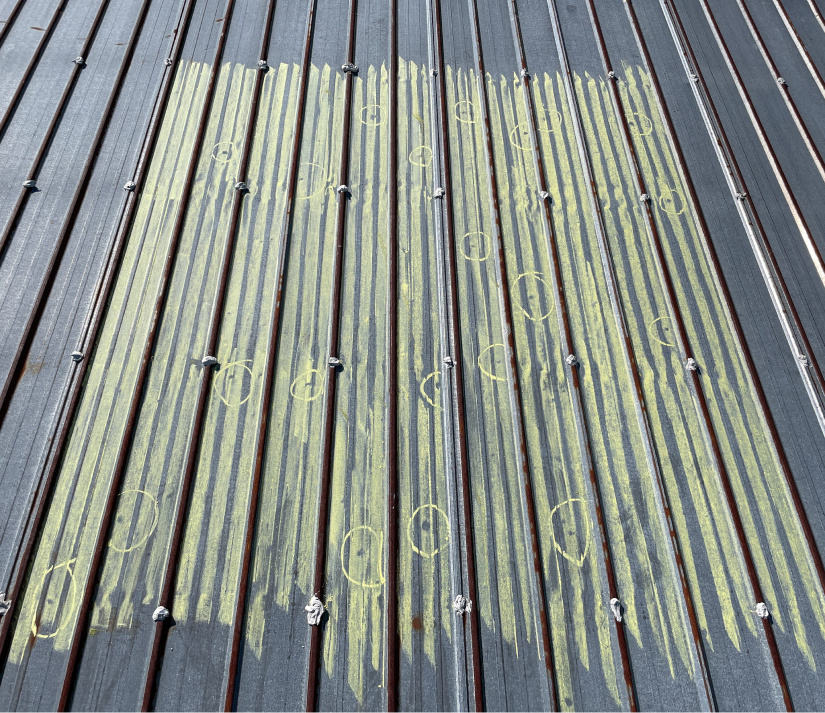

Some hail impacts may be observed from standing height. Other damage requires observation from fewer than two feet (requiring technicians to crawl). Some hail is large and dispersed. Some hail is small, dense, and lands in a concentrated area. PVC creates beautiful spirals when fractured. Shallow metal dents can look like someone took an eraser and dotted your roof.

In short, every hailstorm and roof is idiosyncratic. This prevents the creation of international standards that general contractors can train on and creates a lack of uniformity across insurance carriers.

Why is Hail Damage Identification Challenging?

There is no international definition for hail damage or standardized assessment protocol.

Storm frequency makes expertise impossible without specialization.

Hail damage has a multitude of physical expressions and can be obfuscated by building conditions.

Each building envelope and storm is unique.

It is difficult to gain the experience required to document hail damage without specialization. This is partly due to hail’s unpredictable nature: hail doesn’t strike the same place often enough for generalists to build expertise.

The lack of documentation standards and how damage expresses itself differently across building envelopes and hail sizes also hinders training, making it difficult for general contractors to observe anything other than catastrophic damage with obvious leaks.

Experience identifying and repairing hail-damaged residential properties does not transfer well, either. The damage on shingles and other residential roof types is easier to spot, and insurance carriers do not operate with the same scrutiny as they do on large commercial roofs due to the amount of capital at play.

Roofs With Easily Overlooked Hail Damage:

These roofs do not appear to be damaged from this height, but hail damage was identified on each of these roofs by a HailSolve technician.

What are the Best Ways to Mitigate Identification Risks?

In light of this complexity, CRE owners need to be diligent in their vendor selection for hail damage analysis and risk mitigation.

Good vendors will:

- Express logical skepticism that damage exists prior to an in-person inspection

- Observe every roof section and not just a limited area

- Document damage beyond leaks

- Have dedicated hail technicians

- Specialize in commercial buildings

- Bring their own standardized process for synthesizing and communicating hail damage

- Make recommendations within the context of insurance and business risk

Without these elements present, CRE owners may work with inexperienced vendors and make ill-informed decisions that reduce value and forfeit roof replacement opportunities.

Restoration Risk:

The risk of unfavorable restoration outcomes, including full or partial denial.

Hail claims are different from wind, fire, or other perils. The evidence and causality of perils like fire are easier to document and have been bureaucratically honed by insurance companies for centuries, creating clear definitions & processes.

Hail damage identification and quantification do not have universal standards, creating confusion during the claim and restoration process.

That confusion creates restoration risk: risk of full or partial denials, risks of inaccurate estimating, risks of jeopardizing tenant relations, and risks of misaligned construction planning squandering rare roof replacement opportunities.

In order for a hail claim to be successful, insurance must agree that:

There is hail damage as defined in the policy

There is an exact date for the damage

There was coverage for that damage on that date

Upon initial inspection, this may appear straightforward; however, reaching a consensus on damage, date, and coverage has unexpected complexity.

Consider this scenario:

An investment group purchased a large manufacturing facility in Kansas City on May 12th, 2024. On that date, the building was added to their %-based deductible policy. This policy does not include a surfacing exclusion for light hail dents.

The evening of May 19th, a storm with a westerly wind produces 1.25” hail over the building’s 10-year-old TPO roof. A week later, the investment group files a claim. After reviewing the roof and associated weather data, the carrier insists that the damage on the roof happened on April 24th, 2024, when a storm dropped 1” hail over the building. They base this on in-house meteorology work that demonstrates how the hail was pushed by a southeasterly wind, matching the direction of the April 24th storm.

They deny the group’s claim in full, citing there was no coverage at the time of the incident, and the investment group pays $650k in repairs.

This appears to be an appropriate, albeit costly resolution.

That isn’t always true, however.

Consider this alternative:

What if upon denial the owner’s team worked to assemble damage documentation that separated the storms? And that the impacts from April’s southeasterly wind did not damage any seam joints, but impacts that fell toward the east on May 19th did?

And although the severe impacts of May 19th’s storm were concentrated, consider if the owner provided documentation of shallower hits on the remaining roof sections, arguing for their inclusion in the settlement since surfacing damage isn’t excluded in their policy?

The ability to navigate that complexity is why hail risk management firms are so valuable. Numerous scenarios can arise from discrepancies in data, damage, and coverage. Without technical expertise and a reliable partner network, CRE owners cannot understand when they have recourse after a denial, increasing the risk of paying for roofs that may be covered.

Claims are only the beginning.

Agreeing on damage, date, and coverage is only the start. Carriers provide restoration estimates, which are best reviewed by restoration experts. After a settlement, construction specifications based on portfolio goals and municipal codes requires extensive planning, and this is prior to project managing the restoration itself.

Hail restoration’s complexity creates risk—delays, inefficiencies, and misunderstandings. While adjusters and Tier-1 General Contractors may form adequate restoration solutions, owners and team members must manage multiple technical vendors throughout a complex process, one that rewards errors with heavy bills and distracts themselves from day-to-day operations.

Insurance Risk:

The risk of volatility due to mismanagement of hail-related coverage

There are two primary insurance risks: non-renewal risk and coverage risk.

Both submissions of invalid claims and/or aggressive management of claims can jeopardize relationships with carriers and brokers, increasing non-renewal risk. Each claim must be assessed within portfolio-wide insurance continuity and strategy. The recurring frequency of renewals also increases non-renewal risk.

Coverage risk involves the misunderstanding of coverage and its relationship with actual building conditions.

Insurance coverage for hail damage is complex, with numerous options and sophisticated policy language. Without effort applied to remain aware of a dynamic insurance market and the ability to filter coverage choices through building sciences considerations, CRE owners can develop a false sense of security in their coverage, resulting in frustrating and expensive hail restoration outcomes.

Here are few insurance mechanisms and terms that affect hail risk:

- Actual Cash Value vs. Replacement Cost Value

- Percent-based Deductibles

- Co-Insurance

- Ordinance & Law Allowances

- Roof Surfacing Endorsements

- Roof Surfacing Payment Schedules

- Deductible Buy-Down Policies

- Parametric Coverage

Without a thorough understanding of how these mechanisms affect exposure in relation to actual building conditions, owners can be caught off guard when hail damage occurs.

For a breakdown of these terms and their implications, please refer to:

Enterprise Risk:

The risk of increased exposure and loss as a portfolio grows

Like any business system, size yields complexity. Managing hail risk on one building is easier than managing fifty. Notification, identification, restoration, and insurance risk all compound with additional buildings and larger teams.

Here are a few examples of enterprise hail risk:

- Navigating hail notifications on 75 buildings becomes untenable, creating notification fatigue and reducing the likelihood of a coordinated response when storms occur.

- A hailstorm impacts 7 buildings with large hail. A lack of process and SOPs creates a web of duplicate vendors, inspections, and misunderstandings between internal and external teams.

- During a busy year, a portfolio misses the chance to receive three roof replacements through insurance due to misidentified or misunderstood hail damage.

- A portfolio acquires another investment group’s properties, inadvertently purchasing 6 buildings with existing hail damage.

- A portfolio is hit by a last minute non-renewal, and historical failure to diversify policies and properties across carriers creates exposure.

HailSolve has successfully helped us to restore twelve properties within our portfolio. We completely trust their team and would highly recommend them.

What Does an Effective Hail Risk Management Program Look Like?

Hail risk programs are proactive engagements to minimize disruptions and losses that arise from hail. Like other risk management practices, these programs are best when quantitative data intersects with effective communication & processes.

A hail risk program may have all or some of these components:

- Hail alerts/active monitoring

- Dedicated team members for onsite analyses

- Defined communication channels

- Periodic reviews of portfolio-wide hail data to identify restoration opportunities and risk bundling opportunities

- A shared pool of insurance insights being shared between CRE owners

Key Benefits and Risks of a Hail Risk Program

| Effective hail risk programs can: |

|---|

| Reduce maintenance and repair bills |

| Enable reallocation of capital expenditure reserves |

| Protect portfolio value |

| Strengthen tenant relations |

| Simplify restoration project management |

| Ineffective hail risk management can: |

|---|

| Waste capital on roofs that would have been covered |

| Inadvertently purchase hail-damaged properties |

| Have inadequate coverage following an event |

| Accelerate depreciation on assets |

| Add labor costs from inefficient processes |

Use one vendor for everything hail

Effective hail risk management requires a specialized approach that addresses notification, identification, restoration, insurance, and enterprise risks. By partnering with a trusted expert like HailSolve, property owners can protect their assets, optimize their insurance coverage, and make data-driven decisions to minimize the impact of hail events on their portfolios — all from a single source.

Discover our full spectrum of services:

Contact Us

Speak with a Hail Risk expert today.